One Of The Best Personal Finance And Budgeting Apps For 2025

The company serves 5 million+ present members, and presents a free “studying middle” to assist break down what could presumably be frustrating features of your financial membership into easy-to-do tasks with zero stress. Rocket Cash distinguishes itself with its top-notch user interface and navigation system, which permits it to offer you quick solutions to your finances with zero trouble. You can use Rocket Cash on any platform, desktop and cellular, so it’s extremely accessible to any user.

TurboTax isn’t fully free for everybody to reap the benefits of all their features, however they do supply a great TurboTax free personal finance software for simple tax returns. You can use this software on any gadget and sync all of your accounts for a one-place budgeting app and monetary knowledge platform. The reporting is very detailed and correct for investment accounts, expense tracking and other monetary administration dashboards.

- But managing finances on paper may be time-consuming at best and an impossible endeavor at worst.

- Even those who cost for his or her providers — and lots of do — more than justify their price with consistent use.

- Steve Rogers has been knowledgeable author and editor for over 30 years, specializing in personal finance, funding, and the impact of political tendencies on financial markets and personal funds.

Quicken has a 4-star common on Google Reviews and a three.7-star ranking out of 5 from third-party evaluation sites. In basic, prospects who liked Quicken had been business owners https://www.intuit-payroll.org/ who needed to benefit from the tax-season benefits of this software. For over forty years, PCMag has been a trusted authority on know-how, delivering unbiased, labs-based evaluations of the newest services.

HomeBank will attraction should you work on multiple platforms, or don’t use Home Windows by default. Out There for Windows, macOS and Linux (there’s also an Android app in development) HomeBank can be put in normally or as a transportable app, and it makes the topic of non-public finance easily accessible. If you’ve been using one other program – similar to Quicken or Microsoft Cash to manage your funds, you presumably can import knowledge to save heaps of having to start out from scratch. However, there is certainly a value for these further power instruments and Monarch is not the most price effective option out there in the monetary software marketplace. It is possible to pay an annual fee, rather than taking place the route of monthly payments, which makes the product slightly cheaper. Monarch, although, is basically going to appeal to people who find themselves very severe about getting their funds in order.

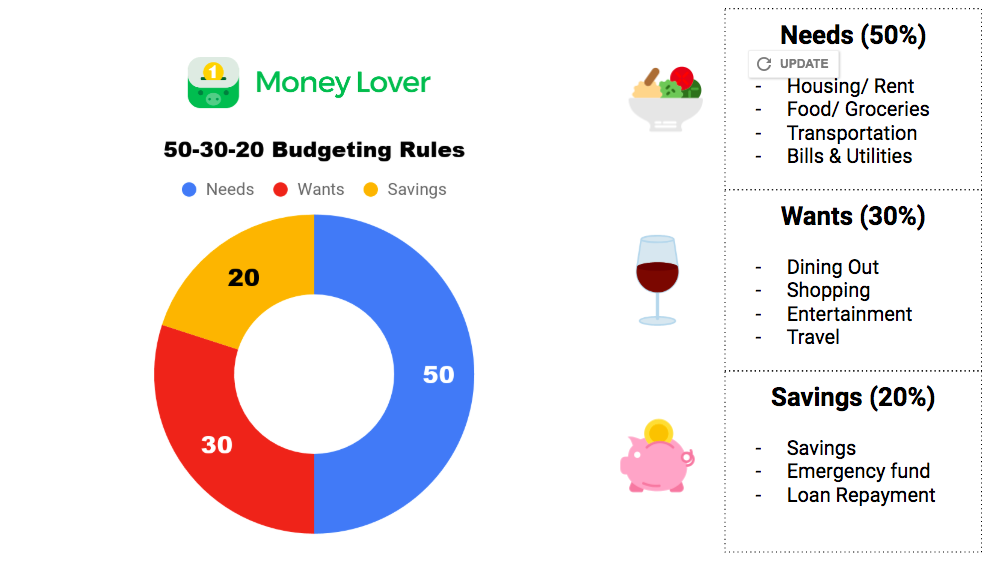

Greenlight

Good personal finance habits help reduce stress, keep away from unnecessary debt, and create a transparent path towards financial freedom. Personal finance refers again to the administration of an individual’s or household’s cash, including budgeting, saving, investing, and planning for future expenses. It covers everything from daily spending and debt administration to long-term targets like shopping for a house, funding schooling, or making ready for retirement. This roundup covers the 10 greatest software for personal finance that help you observe spending, automate financial savings, and plan for the future—all while providing you with the readability and control you want. Whereas it doesn’t track and categorize spending like other apps on this record, it focuses on serving to you enhance your credit score, which is crucial for your private finance targets. The software costs $14.99/month, or you presumably can pay yearly for $99 a year (making it $8.25/month).

After you’ve spent $1,000+, you’ll earn 0.125% again in inventory on each swipe. It also has a budget calendar that helps you schedule month-to-month payments in an intuitive calendar view. PocketSmith also integrates seamlessly with Xero, a small-business accounting software product. Empower is a robo-advisor that makes money by managing users’ investment portfolios, not recommending third-party monetary services and products. The app makes it straightforward to create a spending plan, categorize your transactions, and make payments between accounts.

Best Private Finance Apps: Budgeting & Monetary Education Apps

SEE Finance 2 is on the market for a single purchase, which sets it aside from a lot of its competitors. The program costs $39.99 and is downloadable immediately onto any system working MacOS. Embracing the advantages of remote work, Banktivity interacts often with its customers, encouraging ideas for improvements or new options. The only draw back with that is that you simply do have to have an Apple system to operate the program, which makes it a no-go for Home Windows or Android users. One of the most well-liked benefits of Quicken is that it simplifies the method of tax-related duties.

For instance, a $50 grocery retailer purchase right now appears as a “Groceries” or “Food” transaction (depending in your preference) tomorrow. Tiller is a service that may join along with your financial institution and credit card to tug every day transaction information into a sheet on Google Docs. You can choose to begin from half a dozen templates or roll your own, but Tiller will update it automatically from 100,000+ monetary institutions. This is necessary as a result of when that data is definitely accessible, it’s easily remembered and understood.

You can manage your personal accounts in addition to your clients, distributors, invoicing, and extra. Cellular entry is critical for private finance and accounting and private tax preparation. So I really have each an iOS and Android phone for testing companion apps, since versions can differ. I use an assortment of tools for work that doesn’t contain managing money, like my Samsung Galaxy A51 phone, Evernote, Gmail and Google Drive. They often require guesswork until you’ve had a finances for several months and begin seeing how your money comes and goes.

Who It’s For

During our analysis into Banktivity’s reputation, we found that Banktivity’s parent company IGG has an “A+” rating from the Better Enterprise Bureau. On high of that, Banktivity exhibits a median score of four.2 stars out of 5 on the Apple mobile app. However, there are fewer reviews for this service than with different firms we evaluated.